Banking & Financial Services

Future-fit banking

Powered by AI and propelled by data, financial services are evolving into ubiquitous digital platforms that are intelligent, automated, and seamlessly integrated with diverse services. Is your company equipped to excel in this rapidly changing landscape?

DIGITAL ASSETS ENVIRONMENTS

ENABLEMENT

INTEGRATE PAYMENTS

& INTERACTIONS

NEW REVENUE STREAMS & BUSINESS MODELS

LEGACY SYSTEMS MODERNIZATION

INCREASE CUSTOMER

LIFETIME VALUE (CLV)

VALUE & PERSONALIZED SERVICES

COMPREHENSIVE CUSTOMER

/ MARKET VIEW

EFFECTIVE CUSTOMER LIFECYCLE MANAGEMENT

ENHANCE PREDICTIVE BEHAVIOR

OPERATIONAL EFFICIENCY

& COST REDUCTION

FRAUD & OPERATIONAL

RISK REDUCTION

GROW CUSTOMER BASE

INCREASE NPS WITH MOBILE FIRST EXPERIENCE AT THE CORE

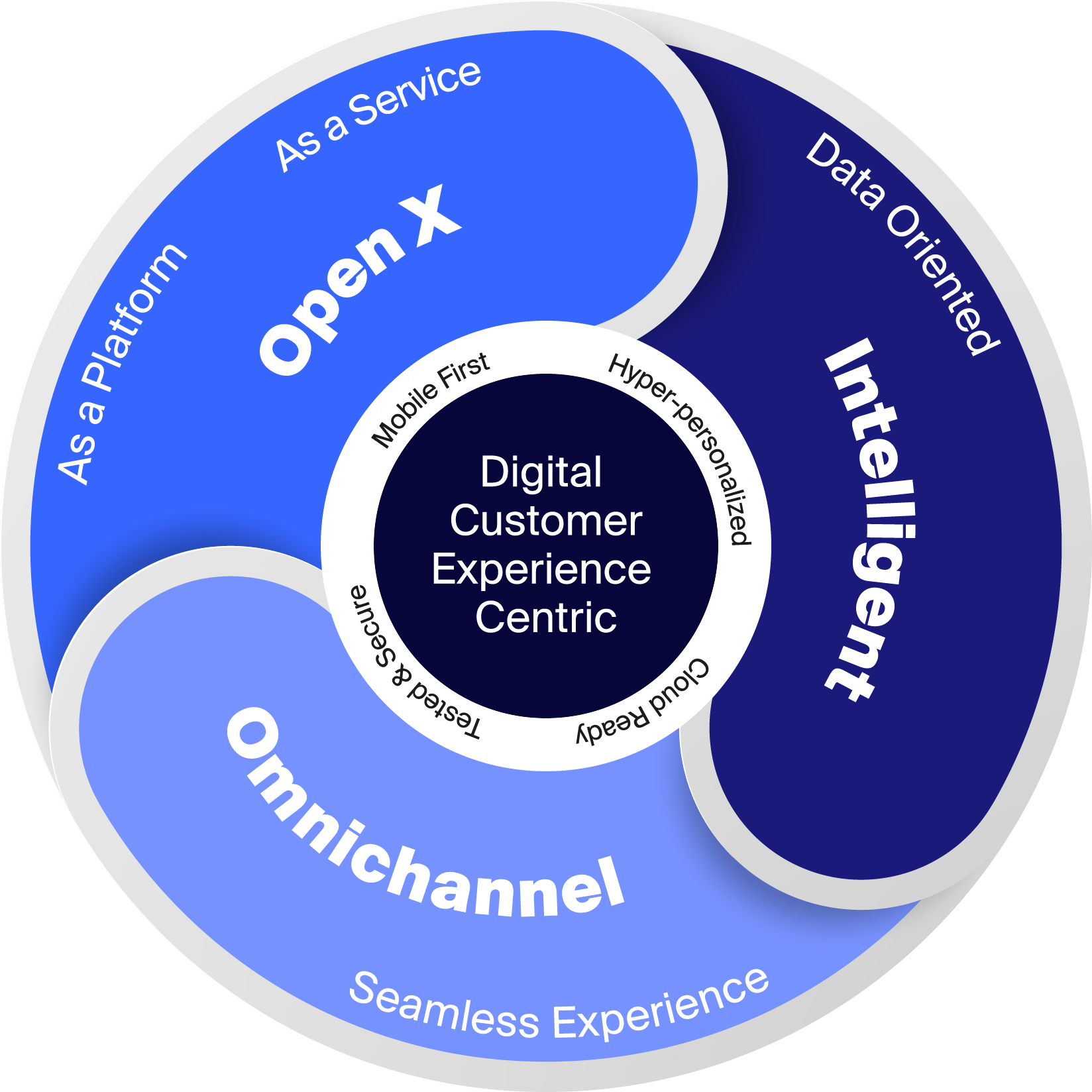

OpenX

DIGITAL ASSETS ENVIRONMENTS ENABLEMENT

INTEGRATE PAYMENTS & INTERACTIONS

NEW REVENUE STREAMS & BUSINESS MODELS

LEGACY SYSTEMS MODERNIZATION

Intelligent

COMPREHENSIVE CUSTOMER / MARKET VIEW

EFFECTIVE CUSTOMER LIFECYCLE MANAGEMENT

ENHANCE PREDICTIVE BEHAVIOR

OPERATIONAL EFFICIENCY & COST REDUCTION

FRAUD & OPERATIONAL RISK REDUCTION

Omnichannel

INCREASE CUSTOMER LIFETIME VALUE (CLV)

VALUE & PERSONALIZED SERVICES

GROW CUSTOMER BASE

INCREASE NPS WITH MOBILE FIRST EXPERIENCE AT THE CORE

CUSTOMER EXPERIENCE ECOSYSTEM

- Customer Engagement & Hyper-Personalization Models (Deep Learning)

- Customer Journey & Product Lifecycle Digitization

- Intelligent Customer Service Enablement

- Omnichannel Models Enablement & Optimization

- User Communities

- Mobile first

DIGITAL PRODUCT ENGINEERING

- Digital Product Development

- Gen-AI Adoption & Governance (IT & Business)

- Digital Architecture

- Open X & API Oriented Architecture Enablement

- Data Architecture

- Cloud Architecture

- QA Engineering

IT PLATFORM MODERNIZATION

- App Modernization - Migration

- End to End Cloud Journey definition & Enablement

- New-Gen Core Banking Implementation & Migration

- Digital & physical channels evolution

- Commercial Banking (SMEs onboarding)

- Wealth Mgmt & Investment

EFFICIENCY & PRODUCTIVITY SOLUTIONS

- Front-Middle-Back Office Processes & Workflows Hyper-automation

- IT Operations (Continuous Improvement & Optimization)

- Intelligent Risk, Compliance & Regulatory Processes

Tech Enablers

Gen AI (Softtek FRIDA and Third-Party Platforms)

Data & Analytics (Deep Learning, Machine Learning)

Multi-Cloud Ecosystem Enablement (AWS, GCP, Azure)

Continuous Innovation (Tech-Emerging PoCs)

Technology Enablers

Key Partnerships

OMNICHANNEL

APP/DATA MODERNIZATION

BPM & AUTOMATION

CORE BANKING INTEGRATION & SUPPORT

AUTHENTICATION

Industry solutions

Digital Onboarding transforms account setup into a simple, paperless process. A few clicks are all it takes to access the digital banking experience.

Send and manage international funds with ease. Our remittance services provide both individuals and financial institutions with secure, quick, and cost-effective solutions.

Experience next-level efficiency in ATM and bank branch cash management. Cash 4 U delivers automated, secure transactions and robust oversight of your cash operations.

Secure sensitive information with Ellenton’s data masking. Our solution upholds data protection laws, prevents leaks, and supports incident management with continuous security monitoring.

Merkaat provides direct and agile financial advisory services online. Access investment guidance, portfolio management, and trading without the traditional wait times and cost.

Featured work

Insights

Simple, Smart, Reliable delivery for what's next.

Tell us what you're working on, and we'll get in touch.